While Chinese and American officials enter heated trade negotiations this week, companies that have built the technology industry’s global supply chain aren’t waiting to see how the talks turn out. In the latest example, Delta Electronics Inc. is joining a wave of key suppliers accelerating a shift of production away from China.

Delta, which makes components to help clients like Microsoft Corp. and Huawei Technologies Co. manage power and cooling for datacenters to factories, is moving some production back to its home base of Taiwan and Thailand amid the threat of a trade war and U.S. security concerns. It’s also taking the unusual step of building three to four plants in India, responding to Prime Minister Narendra Modi’s Make-in-India program.

Fans and thermal management components on display at Delta’s headquarters in Taipei.

U.S. President Donald Trump threw trade negotiations into chaos this week with a threat of higher tariffs on Chinese goods as soon as Friday, accusing Beijing of backpedaling on concessions. With thousands of critical suppliers caught in the crossfire, a growing number are diversifying beyond China to places like Southeast Asia and India.

Delta’s Chief Executive Officer Ping Cheng concedes that India’s technology ecosystem remains far less developed than its giant Asian neighbor’s. But he is keen to add one of the world’s fastest-growing major economies to a production chain that now stretches from Europe to the U.S., via a subsidiary it recently secured a controlling stake in.

Ping Cheng

“The products will be mainly for the domestic Indian market,” Cheng said in an interview last week. “The trend of making in India is inevitable as it’s a big market. But it remains to be seen whether the supply chain locally will in future be complete and used for exports.”

Read more: Top China Trade Negotiator to Visit U.S. as Tariffs Threat Looms

Delta is one of a raft of Taiwanese component makers that form key links in a global supply chain serving the world’s largest tech names. The prospect of sky-high tariffs is prompting the manufacturing powerhouses behind the world’s electronics to scour the globe for alternatives beyond China. That’s threatening to splinter a decades-old supply chain, in which Taiwanese giants operate sprawling Chinese factories to assemble devices that are then sold by the likes of Apple Inc., HP and Dell under their own brands.

“There is no knowing how U.S.-China tensions will play out,” said Gordon Sun, director of the Taiwan Institute of Economic Research’s Macroeconomic Forecasting Center. Rising labor costs and Beijing’s efforts to foster domestic businesses are also encouraging diversification, he added. “Even if there is a trade deal, Taiwanese companies will continue to diversify their production bases.”

Escalating tensions with the U.S. and fears about the security of Chinese-made hardware — particularly in networked and connected products — are also prompting certain customers to request a shift away from the world’s second largest economy, Cheng said.

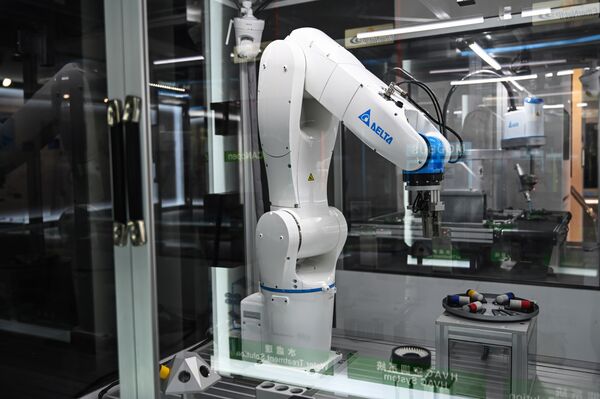

An articulated robot on display at the company’s headquarters.

“Some clients worry that their information may be leaked through backdoors,” he said without elaborating. “We’re moving also due to higher taxes, and we will ask clients to split costs with us, as the expense will increase.”

For many Taiwanese manufacturers, that entails a migration back home. Delta has announced NT$13.2 billion ($427 million) in home investments over the coming three years, and Cheng said his company is looking to hire more than 7,000 engineers over the next half-decade. The aim is to reduce its reliance on China to about 60 percent of its products, versus 70 to 73 percent currently, though Cheng said in the long term the company will continue to invest in China and revenue from that country will continue to grow.

“Our production used to be in China mostly. With a trade war happening, we realized it’s too concentrated,” he said.